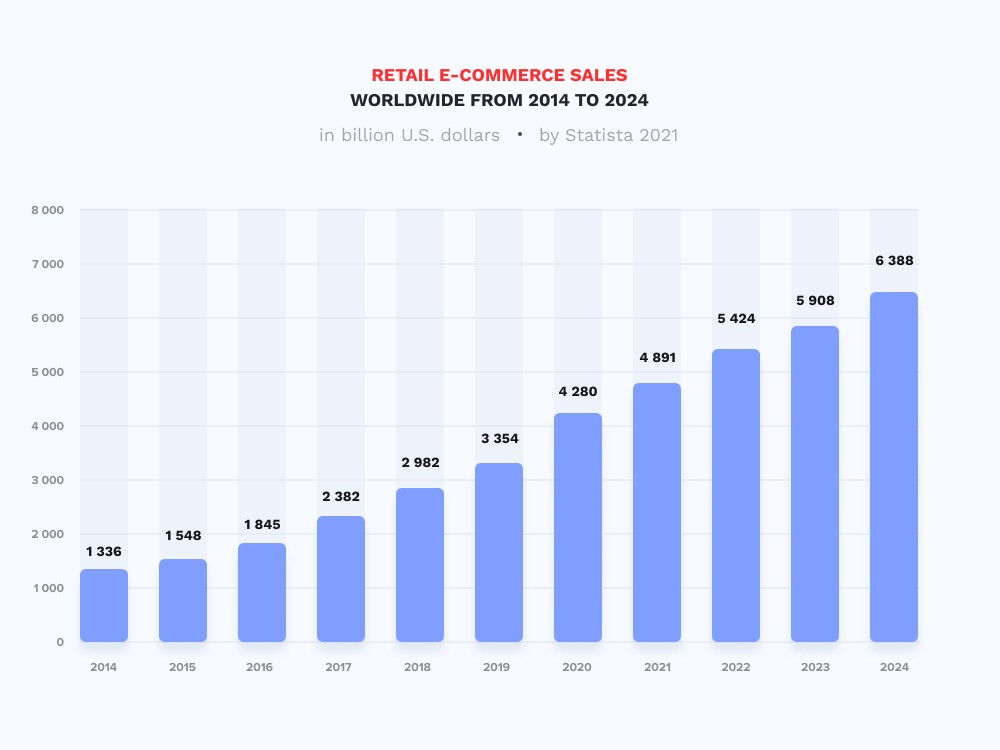

A trend of overwhelming digitalization has changed multiple industries and our society as a whole. Ecommerce is a great example of that, as it has become a noticeable part of the worldwide retail framework. In 2019, overall eCommerce sales amounted to over $3.5 trillion. And its role has become even more apparent during these trying times of the global pandemic, with its growth projected to be more than $6.5 trillion in 2022.

For any business to succeed in the field, one of the critical aspects that need attention is payment processing. This is a function of payment gateways. Choosing an online payment gateway that is secure, easy to set up, flexible, and cost-effective is a crucial task, sometimes difficult to perform.

There are dozens of payment gateway options, each with certain features and specifics. And the stakes are high — your brand integrity depends on it, along with the shopping cart abandonment rate. So, how do you choose the gateway that meets your business goals without breaking the bank or having to pass along hefty fees to your customers? Let’s take a look at the most popular payment gateway comparison to find out.

Challenges in the Choice of the Payment Gateway

The answer to the question of how to choose a payment gateway depends on an assortment of factors. Different gateways cater to various businesses, which is why they have distinct features that allow them to complete specific tasks. Both the number of options out there and the difference in features make the choosing process challenging.

For example, some gateways are hosted, meaning that the customer gets redirected to a secure third-party page to complete each checkout. Others are integrated, allowing buyers to perform the transaction without leaving the website. The first option is easier to implement, while the second one provides better UX and more control to the shop owner. If you don’t need many customization options, there is no need to spend more money and time actualizing the second option.

Top payment gateway providers comparison

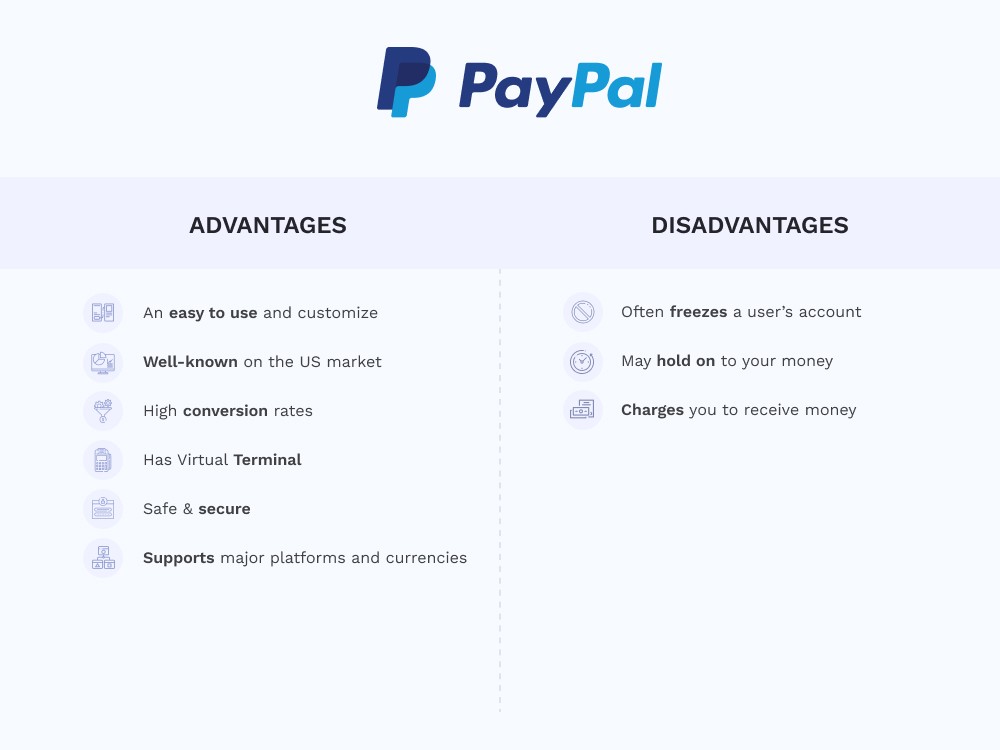

PayPal

PayPal is a startup established in the early 2000s, co-founded by Elon Musk. Turned into the subsidiary of eBay, it only recently has become its own separate entity. Now it’s one of the biggest online payment services, with more than 220 million active users.

PayPal’s payment gateway is easy to set up and customize. Furthermore, it is well-known on the US market even by people who don’t use the platform, which makes the companies that use it look more trustworthy and ensure high conversion rates. With a PayPal Pro Plan, you can design your checkout page and use the Virtual Terminal. It supports major platforms and currencies and complies with PCI security standards.

One of the major disadvantages of PayPal is that your seller account can be instantly frozen if the buyer opens a dispute. And you might have trouble getting it to function again — PayPal customer support is notoriously inconsistent in its quality.

PayPal operates on two business models. Standard PayPal gateway requires no monthly fees but gathers $0.30 and 2.9% from each transaction. PayPal Pro has the same fee per payment, but also requires a $30 monthly fee from the user.

Stripe

If you look at any payment gateway comparison, you’ll often see Stripe as a close second to PayPal. With investments from PayPal co-creators, this platform has been rapidly evolving since its creation in 2010 to become known as one of the best solutions that put developers first.

Stripe is not an out-of-the-box solution — it’s a set of tools that can help you set up your payment processing in an extremely customizable manner. You can include such features as subscription-based payments and one-click checkout. Unlike PayPal, Stripe is oriented not only at the USA and Canada but also at Europe (with smaller fees per transaction).

As a downside of being highly customizable, Stripe is not easily mastered. To properly set it up, you need to have at least some basic knowledge of a web development language, like Java or Python. But, unlike PayPal, Stripe customer support gains much better reviews, so if you’re having troubles you might try to give them a call.

Stripe requires no monthly fees, but they ask for a 2.9% and $0.30 per transaction. However, for European cards, this fee is around 1.4% plus a small amount. Furthermore, you might make a better arrangement for numerous transactions if your business’s size is bigger than average.

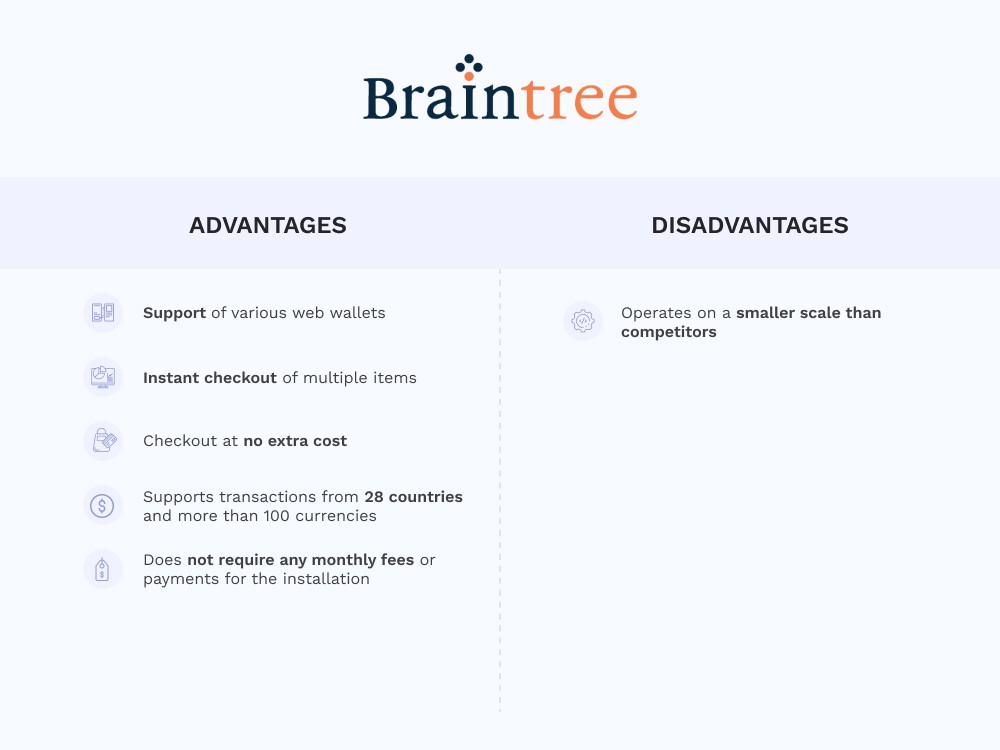

Braintree

Braintree is a startup that in 2011 was considered one of the fastest-growing companies in the world. Its potential was hard to miss, so now it has become a subsidiary of one of the bigger players — namely PayPal.

While comparing online payment gateways, we name PayPal and Braintree on the same list, they actually provide a different experience. What makes Braintree stand out is its support of various web wallets like Venmo, instant checkout of multiple items from different sellers, and integrated customizable checkout at no extra cost.

However, Braintree operates on a somewhat smaller scale. Namely, it supports transactions from 28 countries and more than 100 currencies, which is still less than PayPal does. However, it remains one of the best choices for eCommerce platforms.

When it comes to rates, Braintree does not require any monthly fees or payments for the installation. The fee per transaction is similar to other solutions on the market — 2.9%+$0.30.

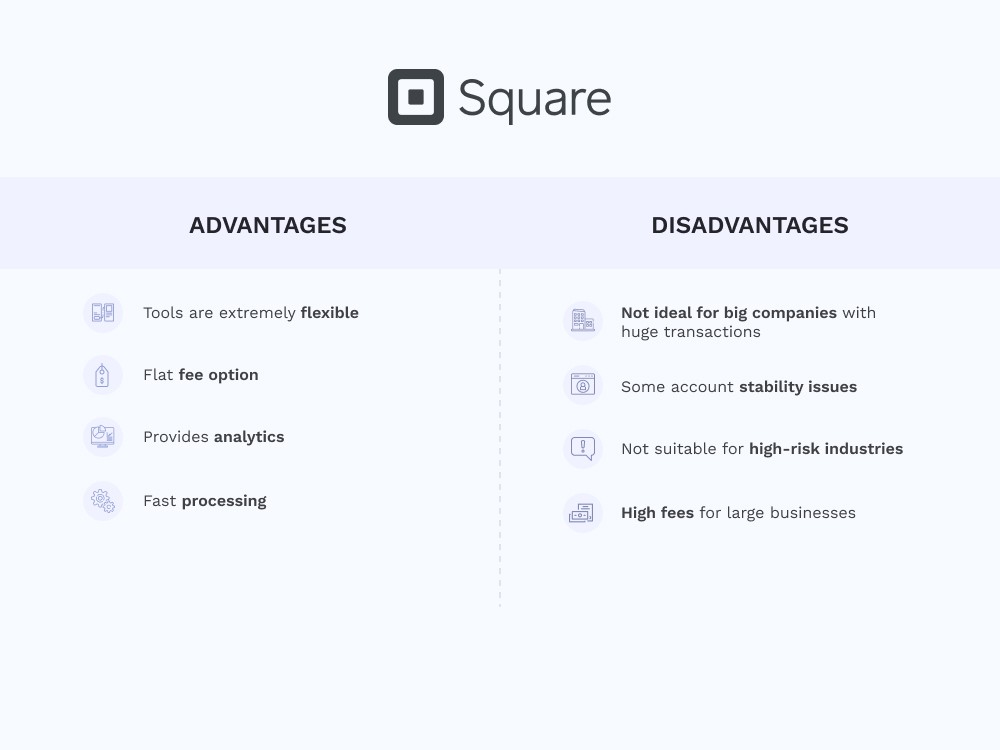

Square

Square is a financial services company created by the co-founder and long-time CEO of Twitter, Jack Dorsey. Besides the payment gateway, the company provides a wide variety of devices and apps that help medium-sized eCommerce businesses.

While Square does not compare to payment gateways mentioned earlier in terms of the number of users, it still provides high-quality services. What sets them apart is that the tools are extremely flexible, especially in terms of the size of your operations. Whether you need to process a small-scale operation or a retail giant, Square will be able to help you out.

The only real disadvantage of Square is its previously mentioned lack of audience reach, which is definitely subject to change. The company grows fast and acquires more and more services, which will make the gateway more popular as well.

In terms of billing, with Square, you don’t need to pay any monthly and set-up fees as well. The fee per transaction stands at 2.6% in addition to $0.10.

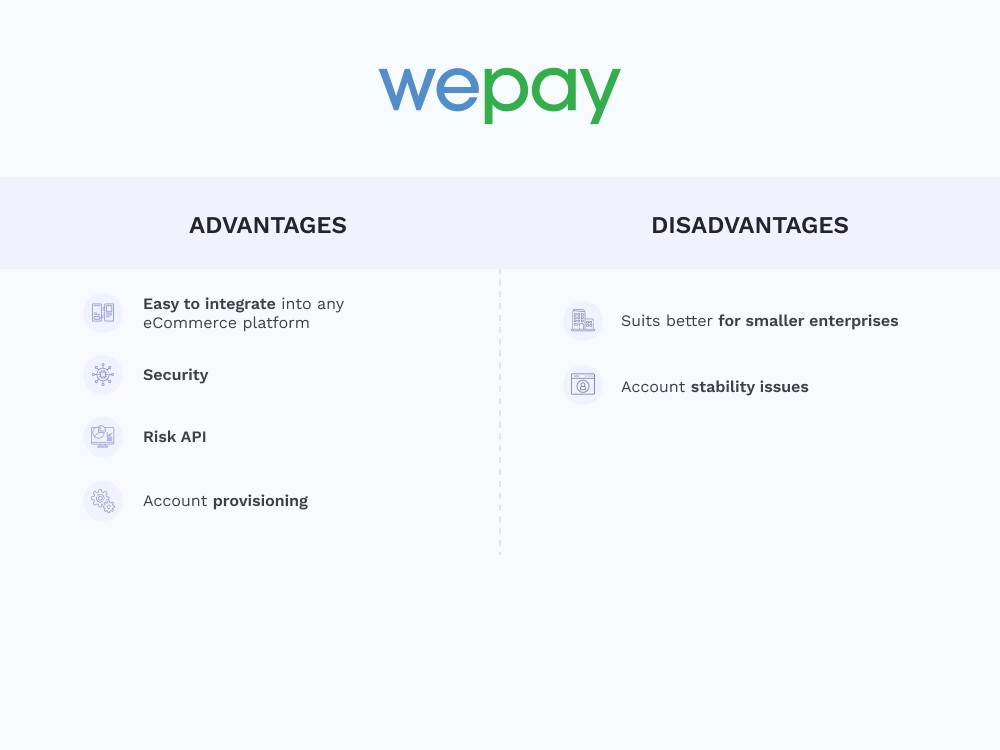

WePay

Last but not least on our payment gateway providers comparison list is WePay. The company was created in 2008 after its creators thoroughly researched PayPal’s weaknesses. They improved upon those vulnerabilities so much that JPMorgan Chase, one of the US’s biggest investment banks, has acquired the company.

WePay does everything PayPal can, and even better. Its API is written exceptionally well, which makes it easy to integrate into any eCommerce platform. It is also often praised for its security, with the service even offering fraud and risk protection as a service.

Unfortunately, WePay reportedly doesn’t handle big transaction flows well. It suits better for smaller enterprises.

Once again, WePay can be set up and used without any additional fees. However, you would need to pay the standard fee for each transaction — 2.9% and an additional $0.30.

Payment Gateway Fees Comparison

Another critical aspect you need to consider during the online payment gateway comparison is how much you would have to pay to use one.

Comparing payment gateways, you might notice that there are different types of fees for the use of the solution. Let’s discuss the most prevalent ones.

First, you might encounter the set-up fee, which you pay once during the gateway integration. The next type of fee you will most likely face is a per-transaction fee. It can be static or variable based on the number of transactions and can range from 0.10% to 20%. The gateway with this type of payment is mostly suitable for small or medium-sized businesses.

When the business’s size reaches a certain limit, paying for each transaction is no longer profitable. This is where monthly subscription-based billing is preferred. Some solutions combine the two models, requiring both a small monthly fee and a fee per transaction.

Let’s compare the fees required by the services mentioned above:

| Payment Gateway | Fees |

| PayPal Standard | 2.9%+$0.30 per transaction |

| PayPal Pro | $30 monthly2.9%+$0.30 per transaction |

| Stripe | 2.9%+$0.30 per transaction |

| Braintree | 2.9%+$0.30 per transaction |

| Square | 2.6%+$0.10 per transaction |

| WePay | 2.9%+$0.30 per transaction |

Mobile payment gateway comparison

Mobile payment gateways deserve a separate mention. Let’s compare the most notable providers in this field.

Top Mobile Payment Providers:

| Provider | Features | Price |

| Visa Checkout | Works with most credit and debit cards, on any deviceFast online paymentsFingerprint identification | Free |

| MasterCard MasterPass | Works with most credit and debit cardsStores previously used card informationMulti-level security (password, security question) | Free |

| Google Wallet | Works with most credit and debit cards, or directly with bank accountsWorks through the app or GmailInstantaneous transactions | Free |

| Apple Pay | Works with most credit and debit cardsTransactions can be made with an iPhone, iPad, or Apple Watch | Contact for pricing |

| Intuit GoPayment | Works with any type of paymentEncrypted credit card processingFree card reader | $0 per month2.4% per swipe3.4% per keyed in$0.25 per transaction$19.95 per month1.6% per swipe3.2% per keyed in$0.25 per transaction |

Our Experience

Our team has worked on multiple projects concerning handling payment processing. More often than not we handle the monthly/annual subscription to the SaaS platform we’re developing. A popular solution is to set up manual transaction management through the admin panel.

Another problem we deal with is the internal ecosystem of payments. This includes cases where one user makes the payment, and another receives the money. All in all, we suggest solutions that worked for us and dozens of other software businesses.

Final Thoughts

There are a lot of variables to consider when choosing the most suitable payment gateway for your platform. And if you make the wrong choice, you might lose a large chunk of your budget, or worse — lose the trust of your users. If you’re having trouble deciding on a platform, we’re ready to share our experience and help you with the solution. Contact the OSDB team to find out more.